Vodafone Idea Limited is a telecom company. It provides a way to talk and use the internet over their phones. They work on both older and newer networks. They also help big companies, small businesses and startups with their communication needs. It offers services like calls, internet connection and streaming digital content.

It had a very good performance but as Jio came into market the company had to struggle to survive in the market. In this article, we will discuss Vodafone Idea Share Price Target 2025, the factors affecting the market and more.

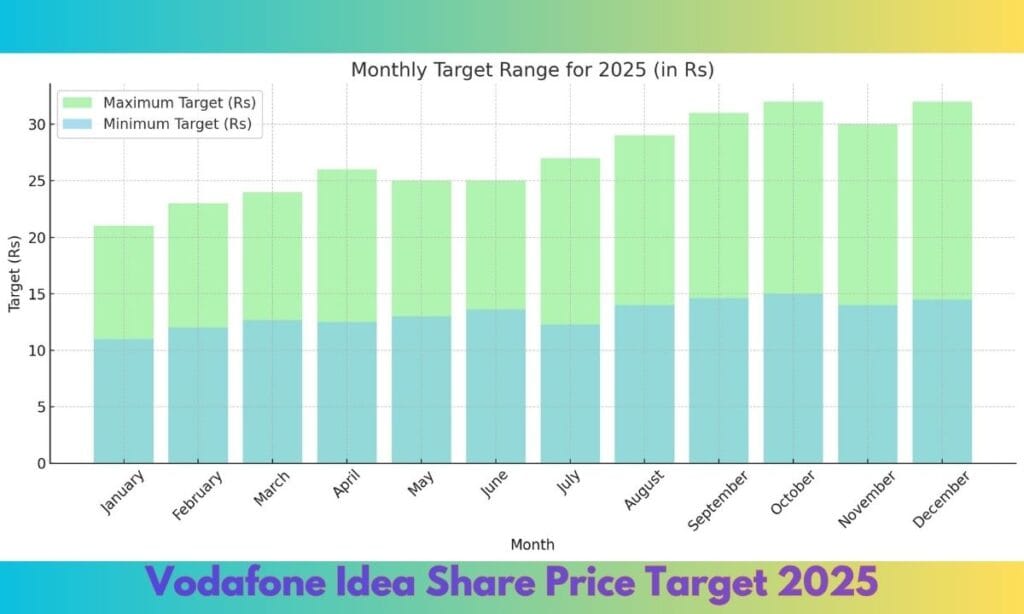

Overview Of Vodafone Idea Share Price Target 2025

Let us discuss Vodafone Idea Share Price Target 2025. It keeps working on improving the network and providing high quality services to the people. They also have a 5G network available to make the services even better. As we know nowadays people are addicted to phones so the company might grow. The minimum price target for 2025 is Rs 11 and maximum target is Rs 32.

| Month (2025) | Minimum Target (in Rs) | Maximum Target (in Rs) |

| January | 11 | 21 |

| February | 12 | 23 |

| March | 12.65 | 24 |

| April | 12.5 | 26 |

| May | 13 | 25 |

| June | 13.6 | 25 |

| July | 12.3 | 27 |

| August | 14 | 29 |

| September | 14.6 | 31 |

| October | 15 | 32 |

| November | 14 | 30 |

| December | 14.5 | 32 |

History Of Vodafone Share

Vodafone is also known as a telecom company and is based in Mumbai and Gandhinagar. It is a GSM operator providing telecom services across India. Vodafone Idea was listed in the stock market on April 19, 2007 and is currently active in the share market. Let us discuss the information of the Vodafone Idea share history:

| Status | Listed |

| Trading Status | Active |

| Date of listing | 9 March 2007 |

| Adjusted p/e | – |

| Index | NIFTY MIDCAP 50 |

| Basic industry | Telecom – cellular and fixed line services |

About Vodafone And Idea

Vodafone Idea (Vi) formerly known as Idea Cellular Ltd is a provider of telecommunication services. It provides calling, internet services and broadband services. It offers 2G, 3G, 4G and 5G wireless networks. It provides Iot solutions to both public and government sectors, public and private enterprises and startups. They have their headquarters in Mumbai, Maharashtra, India.

In 2017, Vodafone India and Idea Cellular announced their merger. This merger was approved by the telecommunication department in 2018. After the approval the new company emerged, Vodafone Idea Limited.

Vodafone Idea Share Price Target (2024-2030)

Vodafone Idea shares have set up a common and basic performance over the past years. Let us discuss about the Vodafone Idea share target price from the year 2024 to 2030:

| Year | Share Price Target |

| 2024 | 21 INR |

| 2025 | 27 INR |

| 2026 | 40 INR |

| 2027 | 57 INR |

| 2028 | 73 INR |

| 2029 | 95 INR |

| 2030 | 105 INR |

Current Position On 2024

Vodafone Idea has been facing a lot of problems with owning a lot of money which is worrying the investors. They are trying to fix the problem by selling assets and raising money. But they are still in debt. The share price is dropping as of 2024 the minimum price recorded is 8 INR and maximum price is 24 INR.

| Month (2024) | Minimum Target (in Rs) | Maximum Target (in Rs) |

| January | 14 | 17 |

| February | 15.5 | 19 |

| March | 12 | 15 |

| April | 12.6 | 17 |

| May | 11 | 15 |

| June | 18 | 24 |

| July | 15 | 22 |

| August | 13 | 17 |

| September | 8 | 15 |

| October | 8.6 | 15.5 |

| November | 9 | 16 |

| December | 9.8 | 18 |

How To Purchase For Vodafone Idea Share Price

You can purchase Vodafone Idea Share from numerous shopping for and selling structures such as Zerodha, Groww, Angel One and Upstox. Along with this Vodafone Idea Share competes with various other companies in the telecommunication region including

- Bharti Airtel

- Reliance Jio

- Bharat Sanchar Nigam Limited (BSNL)

- Tata communications

Advantages And Disadvantages of Vodafone Idea Share

Let us discuss the advantages of purchasing Vodafone Idea Share:

- Large customer base market in India.

- There is an increase in the services for 4g and 5g wireless networks.

- Partnership among vodafone group and aditya birla group.

Disadvantages of Vodafone Idea Share:

- They have high debt which can’t be cut down even by selling assets and raising money.

- competitive stress among big telecom services providers such as Jio.

- Regularly disturbing situations inside the Indian Telecom region.

Conclusion

To conclude, Vodafone Idea Share price is decreasing due to the large amount of debts that are present on the company head. The price of share in 2024 was minimum price recorded is 8 INR and maximum price is 24 INR. We have discussed Vodafone Idea Share Price Target 2025 in detail with all the possible factors that can affect the share price with the future predictions of the year 2025 to 2030.

Disclaimer

“The above article is based on our own research. For more precise and accurate data kindly refer to the concerned platform.”

FAQs

Vodafone Idea Share Price Target 2025 predicted by analysts is minimum 11 INR and maximum 32 INR.

The competitors of Vodafone Idea Share includes Bharti Airtel, Reliance Jio, Bharat Sanchar Nigam Limited (BSNL) and Tata communications.

As of now, there is high risk in investing in the company as the company is in high debt. Hence, the investors need to be careful.

Read More Related Article Here